Operating cash flows are firmly positive over the last several quarters, so the business remains healthy from a financial point of view. This means that, in spite of the rapidly growing sales, LinkedIn lost money on a net income level during the first half of 2015. LinkedIn is in heavy reinvestment mode, and recent acquisitions such as are hurting profit margins. This provides enormous room for growth for a company that is expected to generate nearly $2.9 billion in total sales in 2015. Management estimates that the total addressable market for LinkedIn could be worth around $115 billion in the long term.

Marketing solutions is basically online advertising, and the business produces 20% of total revenue, with sales from this segment increasing 32% during the second quarter of 2015. This segment accounts for 18% of sales, and it delivered a year over year increase in revenue of 22% last quarter.

Linkedin stock upgrade#

LinkedIn members can opt-in to premium subscriptions to upgrade the service. LinkedIn has 37,425 companies using its services as of the last quarter, an increase of 33% from the same period last year. Page views grew 35% versus the second quarter in 2014, so engagement trends look encouragingly healthy. The company ended the second quarter of 2015 with 380 million members, an increase of 21% year over year. Companies and individual users want to go to a platform offering the most opportunities for business relationships and new jobs, and this provides a self-sustaining virtuous cycle of growth and increased competitive strength for LinkedIn. LinkedIn has the first-mover advantage in the industry, and the network effect means that the platform becomes more valuable as it grows in size over time.

Linkedin stock professional#

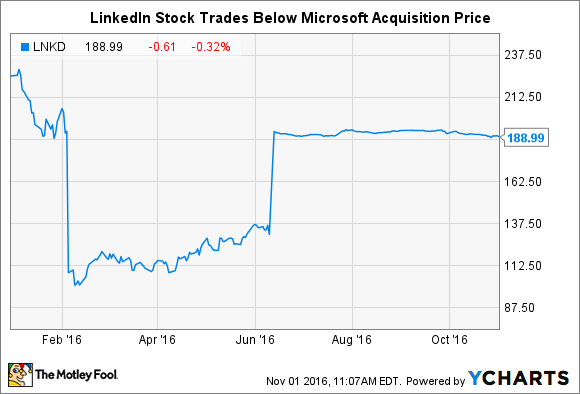

Besides, with practically no relevant competition in its main business, the company is the undisputed global leader in professional contacts and online recruiting. Unlike other companies in the social media business, which broadly depend on online advertising for most of their revenues, LinkedIn has a diversified business model. With this in mind, let's take a look at why I recently bought more LinkedIn stock. Putting too much attention on short-term price fluctuations is generally a bad idea, but it does make sense to review an investing thesis from time to time, especially when prices are moving against your position. The general market has been remarkably weak due to concerns over the economy in China, and LinkedIn stock continued falling to record lows for the year in the neighborhood of $175 per share currently. Things did not go as expected since then. Believing the decline was presenting an opportunity, I added to my LinkedIn position a couple of weeks ago. All Rights Reserved.LinkedIn ( LNKD.DL) stock is on a tailspin lately, accumulating a loss of more than 35% from its highs of the last year. All content of the Dow Jones branded indices © S&P Dow Jones Indices LLC 2019 and/or its affiliates. Standard & Poor's and S&P are registered trademarks of Standard & Poor's Financial Services LLC and Dow Jones is a registered trademark of Dow Jones Trademark Holdings LLC. Dow Jones: The Dow Jones branded indices are proprietary to and are calculated, distributed and marketed by DJI Opco, a subsidiary of S&P Dow Jones Indices LLC and have been licensed for use to S&P Opco, LLC and CNN.

Chicago Mercantile Association: Certain market data is the property of Chicago Mercantile Exchange Inc. Factset: FactSet Research Systems Inc.2019. Market indices are shown in real time, except for the DJIA, which is delayed by two minutes. But over the past six months, shares have started to sink as Facebook ( FB) has soared. LinkedIn had a long, multi-year run as the best-performing social network on the stock market. Related: Facebook is making more money off you than ever before The RBC analysts said LinkedIn's outlook "implies material deceleration in growth." And that means LinkedIn no longer deserves its "historically premium valuation." The firm downgraded LinkedIn's stock and slashed its price target in half - to $156 from $300. It was only a matter of time before LinkedIn gave investors the news they needed to start poking holes.Īnalysts at RBC Capital Markets think LinkedIn has plenty of room left to fall. The average ratio for the S&P 500 is 20.īy trading at such a high valuation, any sign that LinkedIn wasn't performing as well as investors believed meant that the air was going to get let out of the balloon. LinkedIn's shares had been trading at 52 times the company's expected earnings for the year. Investors in LinkedIn had been pumping up the stock - way up - on the belief that LinkedIn would continue to grow strongly for the foreseeable future. You'd think LinkedIn might be down a little bit on the weak outlook.

0 kommentar(er)

0 kommentar(er)